Advisory Opinion 2008-01A

January 18, 2008

Mr. Stephen M. Saxon

Mr. Richard K. Matta

Groom Law Group, Chartered

1701 Pennsylvania Avenue, NW

Washington, DC 20006

Re: Request for Clarification of the Underwriter Exemptions

Dear Messrs. Saxon and Matta:

This is in response to your request for an advisory opinion by the Department of Labor (the Department) concerning the requirements of the Underwriter Exemptions, as amended.(1) The most recent amendment to the Underwriter Exemptions is Prohibited Transaction Exemption (PTE) 2007-05, 72 FR 13130 (March 20, 2007), Technical Correction at 72 FR 16385 (April 4, 2007). Specifically, you request an opinion regarding the application of the terms Affiliate and Restricted Group, as those terms are defined in the Underwriter Exemptions, to the facts described in your request.

You described the following facts. You represent U.S. Bank National Association (USBank), which serves as Trustee of a trust (Trust) holding title to the underlying loans in a transaction involving the securitization of commercial mortgage loans (Securitization). The Securitization was intended to comply with the requirements of the Underwriter Exemptions (UEs). However, USBank believes that it could be deemed to be affiliated with one of the other parties to the Securitization, in violation of the conditions of the UEs. You state that this uncertainty may adversely affect USBanks ability to continue to serve as Trustee of the Trust or to bid to serve as trustee of any similar future securitization transactions. Accordingly, USBank seeks clarification that it is not an Affiliate of a member of the Restricted Group as defined in the UEs.

An entity not affiliated with USBank serves as Sponsor (Depositor or Sponsor) of the Securitization by organizing the Trust and arranging for the engagement of the various service providers to the Trust. The Sponsor purchased commercial mortgage loans from mortgage loan sellers and "deposited" the loans in the Trust created for the purpose of issuing securities backed by the underlying loans (Securities). The Securities were issued in exchange for the loans and were sold through various underwriters. The underwriters sold the Securities to investors who may have included employee benefit plans as defined in section 3(3) of ERISA and plans as defined in section 4975(e)(1) of the Code.(2) A master servicer oversees management and collection services for the underlying loans and distribution of cash flows to the investors. Subservicers are primarily responsible for servicing the individual loans. A special servicer services certain specific loans.

You represent that USBank has formed a joint venture (JV) with an otherwise unaffiliated entity (SUB) that sells mortgage loans to the Sponsor. SUB is 100 percent owned by PARENT, which is one of the Subservicers in the Securitization. On June 13, 2007, USBank informed the Department that neither its joint venture partner, SUB, nor the parent entity, PARENT, is affiliated with the Sponsor. Pursuant to the JV joint venture agreement (the Agreement), USBank owns 51% of the JV, and SUB owns the remaining 49%. The purpose of JV is to originate commercial mortgage loans of the kind that may be sold to sponsors of similar transactions, for deposit into an underlying securitization trust. In the described transaction, you represent that JV did not sell mortgage loans to the Sponsor; however, approximately 6% of the mortgages in the Trust were sold by SUB.

You state that the Agreement provides that USBank and SUB will appoint equal numbers of directors to the board of directors of JV (Board). The Agreement provides that the Board has full control over policy matters and certain management functions and that the Board can only act by unanimous consent. The Agreement provides for the creation of a committee (Investment Committee) responsible for finding, reviewing, and approving mortgage loans. SUB may appoint up to 15 members to the Investment Committee and USBank may appoint up to 8 members. Up to 7 of the members appointed by SUB and up to 2 of the members appointed by USBank can vote at a meeting of the Investment Committee. Some actions require unanimous approval of the members of the Investment Committee, but certain transactions, such as approving mortgage loans under $25 million, require approval by a majority of the members. The members of the Investment Committee may not be terminated or replaced except by unanimous consent of the Board.

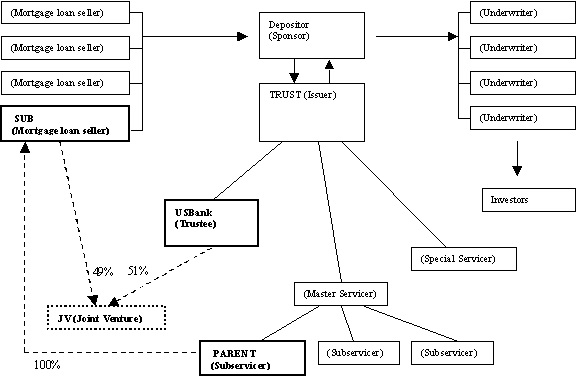

You provided the following chart to illustrate both the Securitization and the various Subsidiary and joint venture relationships (the latter are in bold).

One of the General Conditions of the Underwriter Exemptions, as amended, is that the Trustee may not be an "Affiliate" of any member of the "Restricted Group" other than an "Underwriter." PTE 2007-05, Section II.A.(4). The Restricted Group is defined as: (1) Each Underwriter; (2) Each Insurer; (3) The Sponsor; (4) The Trustee; (5) Each Servicer (6) Any Obligor with respect to obligations or receivables included in the Issuer constituting more than 5 percent of the aggregate unamortized principal balance of the assets in the Issuer, determined on the date of the initial issuance of Securities by the Issuer; (7) Each counterparty in an Eligible Swap Agreement; or (8) Any Affiliate of a person described in subsections III.M.(1)-(7)." PTE 2007-05, Section III.M. "Servicer" is defined to include any Subservicer." PTE 2007-05, Section III.G. "Affiliate" is defined, in part, to include "(1) Any person directly or indirectly, through one or more intermediaries, controlling, controlled by, or under common control with such other person; (2) Any officer, director, partner, employee . . . of such other person; and (3) Any corporation or partnership of which such other person is an officer, director or partner." PTE 2007-05, Section III.N. For purposes of the UEs, "Control" is defined as "the power to exercise a controlling influence over the management or policies of a person other than an individual." PTE 2007-05, Section III.O.

According to your description, PARENT is a Subservicer and a member of the Restricted Group. Additionally, SUB, as a wholly owned subsidiary of PARENT, is defined as controlled by PARENT and an Affiliate of a member of the Restricted Group. Thus, under the definition of the Restricted Group in the UEs, SUB, an affiliate of a Subservicer, is a member of the Restricted Group. You note, however, that, in and of itself, SUB is not a member of the Restricted Group. You state that although SUB sold loans to the Sponsor, such sales alone are not sufficient to make SUB a Sponsor as defined in PTE 2007-05.

You inquire as to whether a finding that USBank is an affiliate of an affiliate of a member of the Restricted Group, would prevent USBank from serving as Trustee for the Trust in accordance with the requirements of the UEs. You contend that if SUB is found to control JV, JV may be deemed to be "indirectly...controlled by" PARENT through SUB. You note that in such a circumstance, JV may be found to be an Affiliate of PARENT, a member of the Restricted Group, and thus JV itself would be a member of the Restricted Group. In addition, USBank may also be deemed to "control" JV. If USBank controls JV, JV would be an affiliate of USBank. As such, USBank would be an affiliate of an Affiliate (i.e., JV) of an Affiliate (i.e., SUB) of the original member of the Restricted Group (i.e., PARENT/Subservicer). To the extent that USBank may be an affiliate of JV and JV is an Affiliate of a member of the Restricted Group, USBank would be an affiliate of an Affiliate of a member of the Restricted Group. You indicated that it is arguable whether JV is controlled by PARENT, SUB or USBank and therefore an affiliate of each of these entities.

The Department does not believe that it is necessary to resolve whether JV is an affiliate of PARENT, SUB or USBank in order to respond to your request. In the Departments view, it is only necessary to address whether USBank is an Affiliate of PARENT or SUB for purposes of determining whether the relief provided by the UEs is available for the Securitization transactions in which USBank serves as Trustee. You assert that USBank is not an Affiliate of SUB merely by reason of the joint venture, JV. The Department agrees that the fact that USBank and SUB are both partners in JV does not make US Bank an Affiliate of SUB for purposes of the UEs. As a result, it is the further view of the Department that USBank is not an Affiliate of PARENT, a member of the Restricted Group, solely by reason of USBanks participation with SUB in the JV.

This letter constitutes an advisory opinion under ERISA Procedure 76-1 and is issued subject to the provisions of that procedure, including section 10, relating to the effect of advisory opinions. This opinion relates only to the specific issue addressed herein.

Ivan L. Strasfeld

Director, Office of Exemption Determinations

Footnotes

The Underwriter Exemptions are a group of individual exemptions granted by the Department to provide relief from certain of the restrictions of sections 406 and 407 of the Employee Retirement Income Security Act of 1974 (ERISA or the Act) and the taxes imposed by sections 4975(a) and (b) of the Internal Revenue Code (Code), by reason of certain sections of 4975(c)(1) of the Code for certain transactions involving the origination and operation of certain asset pool investment trusts and the acquisition, holding, and disposition of certain passthrough certificates representing undivided interests in certain specified assets. You ask us to assume, for purposes of your advisory opinion request, that U.S. Bank National Association acts as a Trustee of a Trust that is the subject of an Underwriter Exemption.

You represent that generally, USBank does not have information regarding the identities of the parties who have acquired the Securities.