Introduction

Claimants initiating the weekly certification process online are often overwhelmed and confused by the information they encounter on a state Unemployment Insurance (UI) agency’s website. As a result, some claimants may misinterpret the questions being asked and inadvertently enter inaccurate information, which can lead to payment delays, improper payments (either underpayments or overpayments) resulting in additional staff time for adjudication, or even a fraud inquiry. Additionally, some claimants do not realize they need to certify, or forget to certify, during the scheduled timeframe.

Such unnecessary confusion, and the resulting administrative inefficiencies that follow, can be avoided with improved communication. State’s digital content, for instance, should include information that promotes claimant comprehension, including language that helps them understand how to certify for benefits and clearly outlines what information they need to provide to determine their eligibility. Below are several recommendations states can implement to successfully guide claimants throughout the certification process.

Recommendation #1: Support claimants’ understanding of the UI certification process by presenting content that is simple, helpful, and informative

Much of the existing content outlining the UI certification process is written with states’ needs in mind rather than framing the process in terms of claimant goals. What’s more, the language describing the process is often written using technical UI terminology that is difficult for the general public to understand. The recommendations below can help states restructure their existing content in ways that help – not hinder – claimants in effectively completing their weekly certification tasks.

Use plain language and consider claimants’ goals when referring to the certification process to promote both comprehension and compliance

Related CX principle: Use plain language

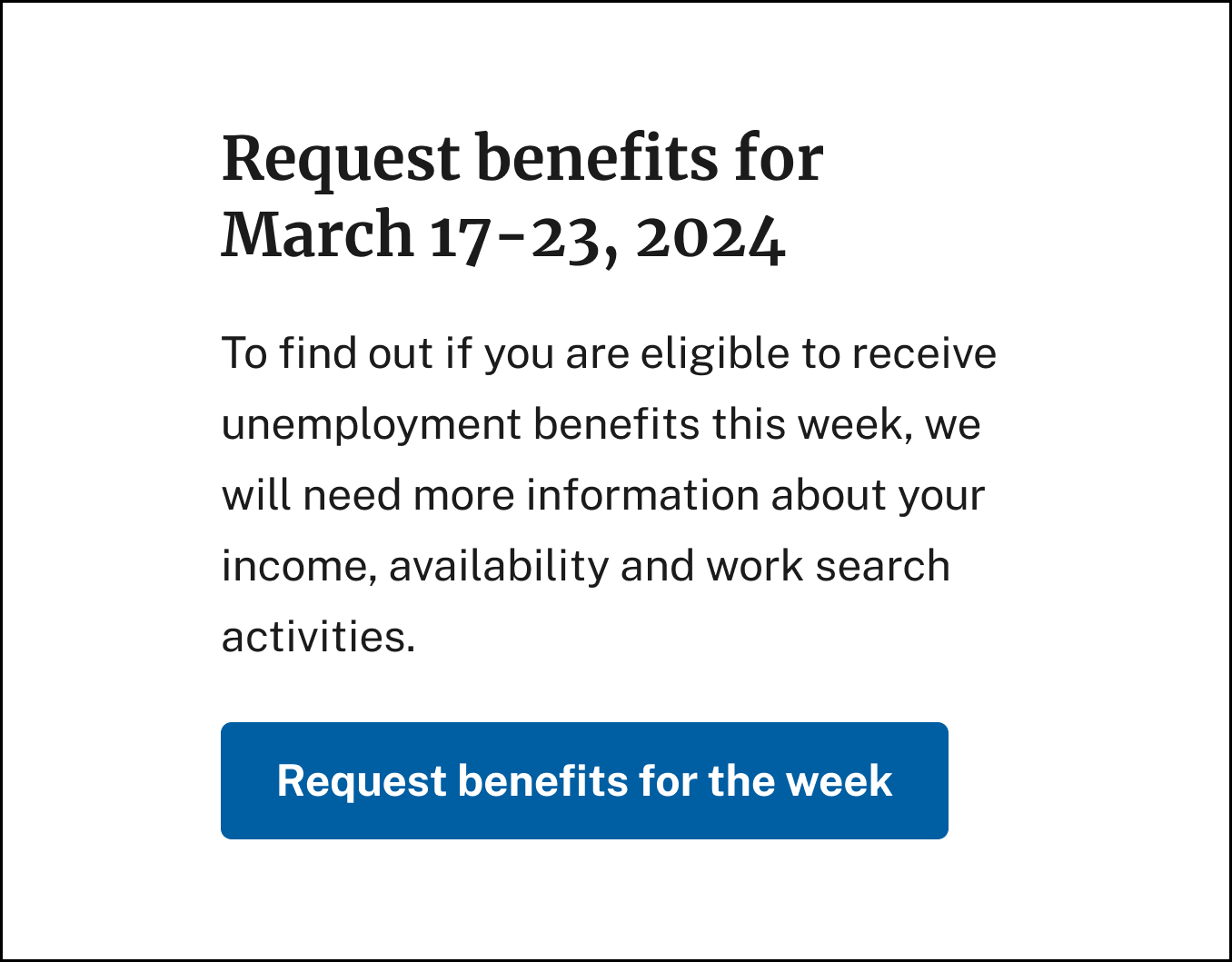

Individuals who are new to unemployment insurance are often unfamiliar with the process and much of the UI terminology used to describe it. Many claimants, for instance, do not realize that certifying for benefits is a recurring requirement that must be completed weekly or biweekly to remain eligible for UI benefits. Consequently, numerous claimants miss out on receiving benefits they are potentially eligible for because they did not understand what the certification process entails. Providing clear, easily accessible information about the certification process, including detailed requirements and a straightforward call to action, can help claimants comply with all necessary steps to receive UI benefits, if they are ultimately deemed eligible.

- Consider claimants’ frame of reference when referring to the weekly certification process. From a claimant perspective, providing their personal information and certifying that their information is accurate are just steps along the way to their goal of getting paid benefits for the week.

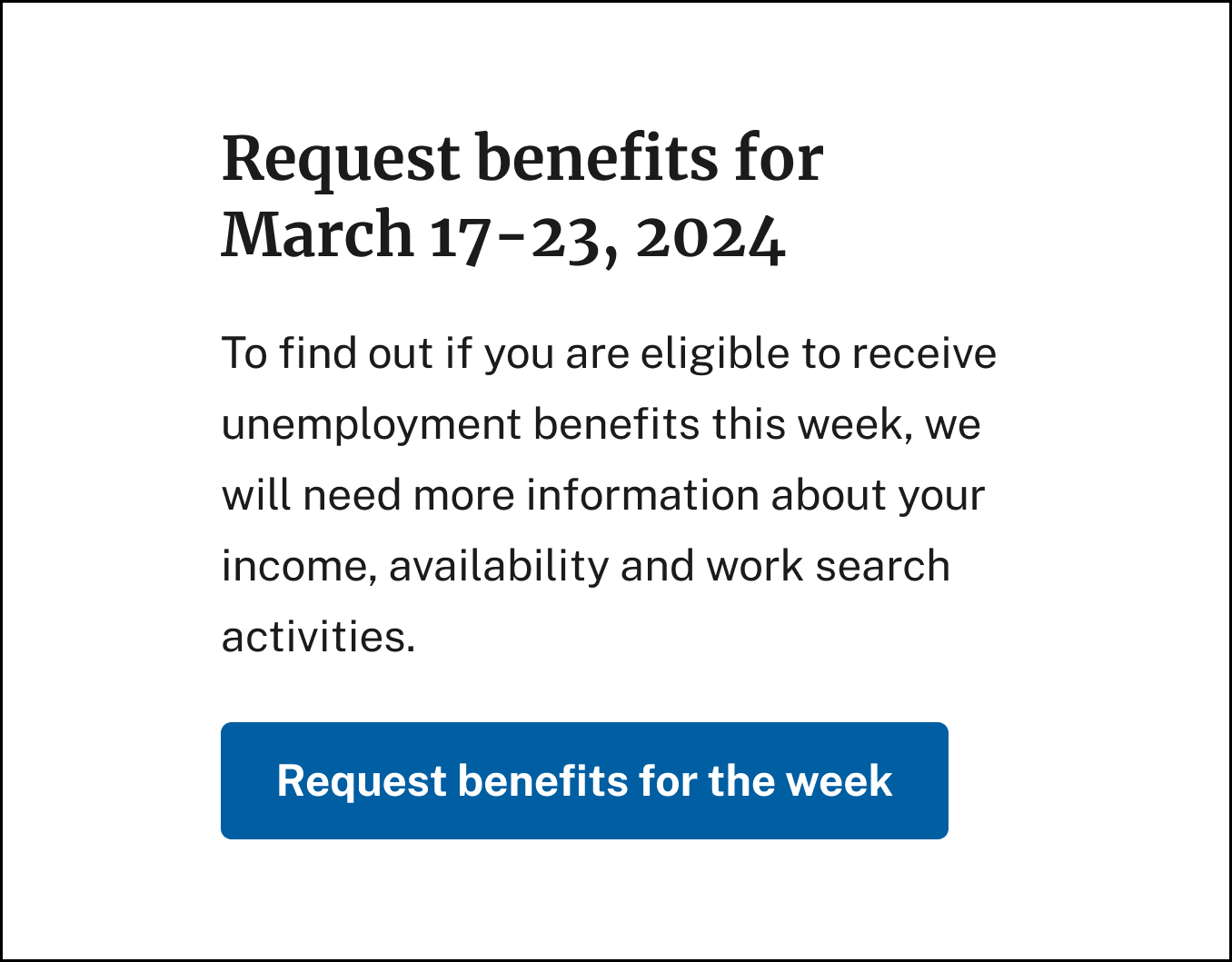

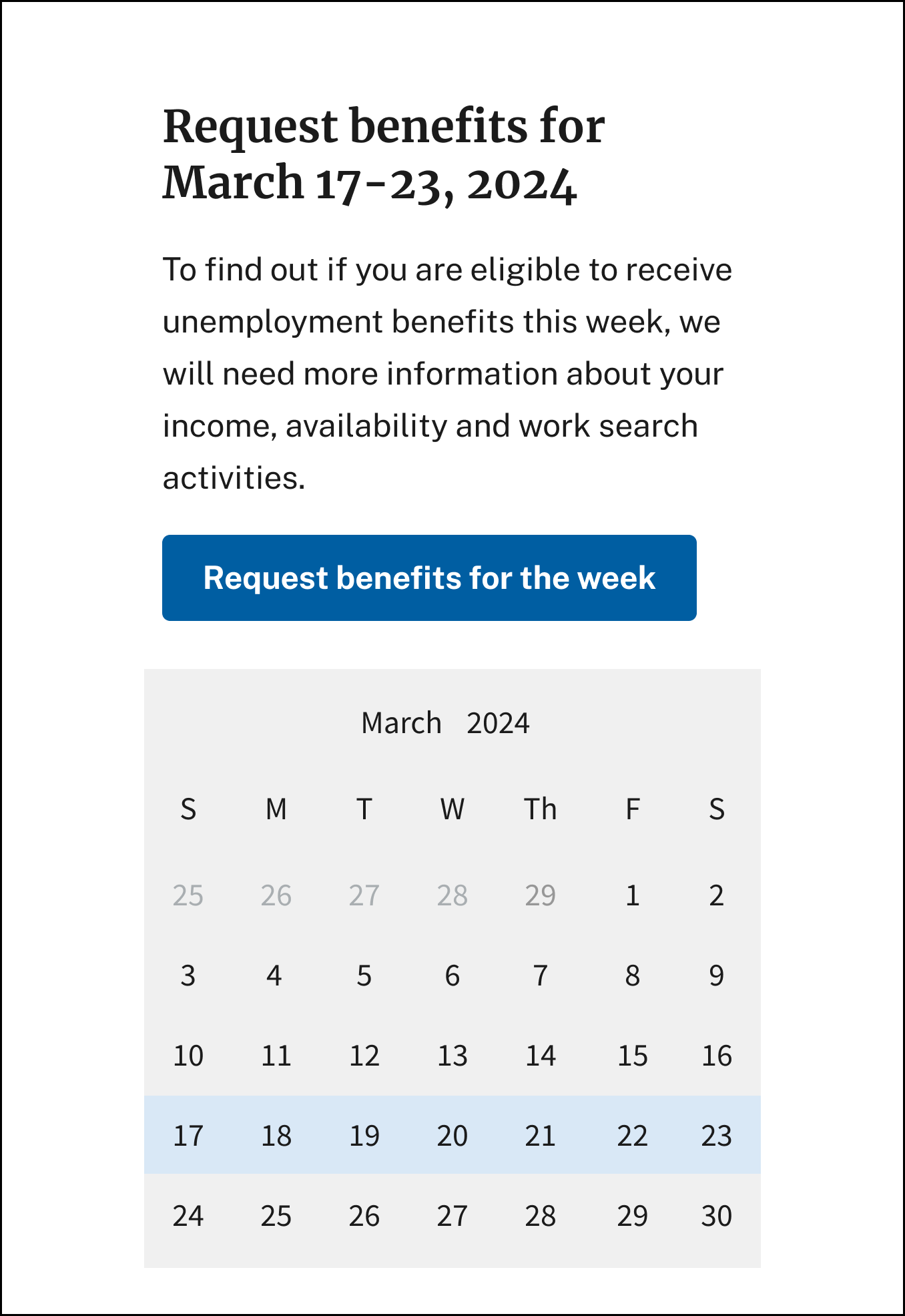

- Focus the call to action on the reason claimants want to certify. Instead of using technical, state-focused terms such as “certification” or “weekly certification,” consider a claimant-centric, plain language call-to-action such as “request benefits for the week.” Using this approach for the link or button text ensures claimants are more likely to complete the process. Refer to the screenshot provided.

- Use explanatory text to describe what the certification process entails. Inform claimants they will need to accurately report work search activities, wages earned, income received, and that they were able and available for work, before they can potentially receive UI benefits.

- Consistency is key for any widespread content changes. If a state workforce agency decides to rename a significant feature, it is essential to ensure such references have been updated throughout the state’s site, as appropriate. One way to achieve this is to conduct a thorough review of the existing content to pinpoint all usages of the specific term/phrase and update accordingly. If there are instances where language from state law must continue to be used and it is not written in plain language, where possible, it would be helpful to cross walk it to the updated plain language used elsewhere on the website.

Use informative, non-threatening language to help claimants answer questions accurately

Related CX principle: Use plain language

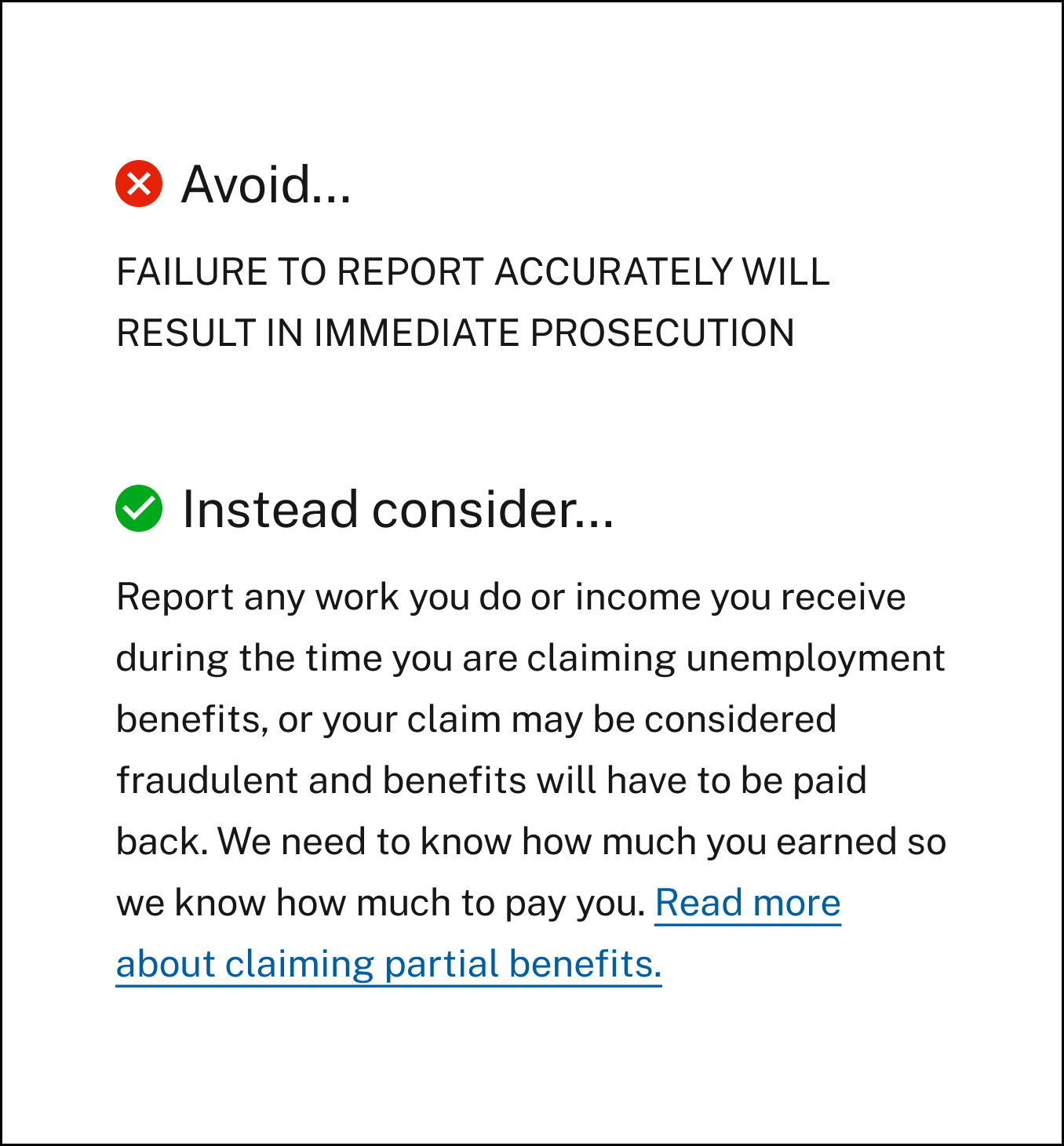

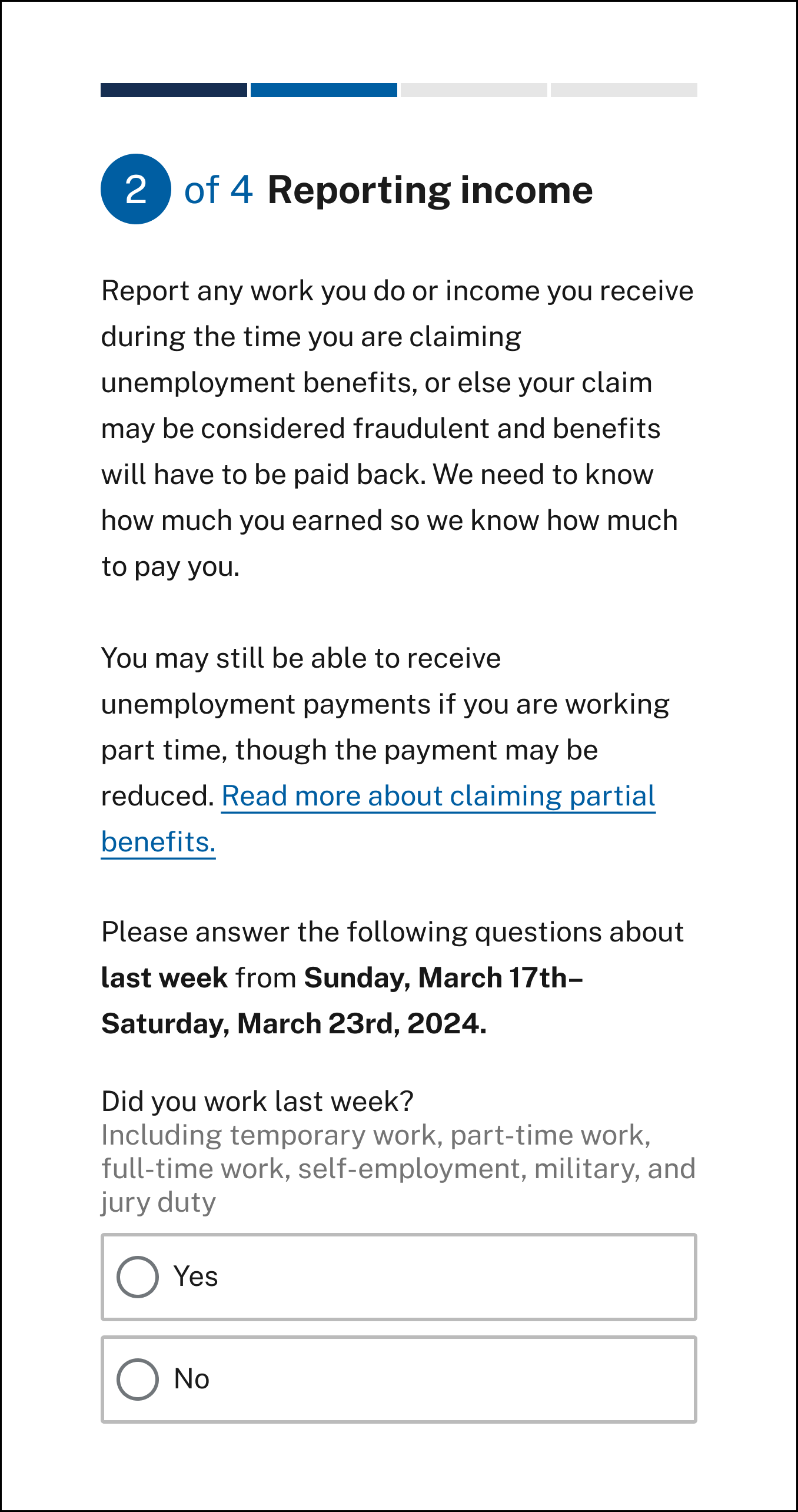

States may use language to discourage individuals from committing fraud on UI applications that feels excessively threatening to some. Indeed, it is extremely important to alert individuals that providing false information has negative consequences. However, emphasizing the importance of providing accurate and complete information in order to avoid these consequences is essential. Otherwise, claimants may unintentionally provide incorrect responses, which could contribute to distrust in government, and/or discourage prospective claimants from applying for UI benefits in the first place. Instead of taking a primarily punitive approach, states should consider providing helpful, detailed information that educates claimants on how to properly complete certification tasks rather than over-emphasizing the consequences of an error or fraudulent response.

- Clearly and specifically explain how a claimant’s answers will affect their eligibility under state law.

- Inform claimants they may still be eligible for benefits even if they have worked part-time. For example: "If you earn partial wages, you may be eligible to receive partial unemployment benefits.” Refer to the screenshot provided.

- Use less intimidating language when possible, as long as it is consistent with federal requirements .

- Avoid the use of all caps to emphasize specific messaging since using capitalized typeface may be perceived as more threatening by readers.

Remind claimants to certify and alert them of any recurring tasks they must complete to maintain eligibility

Related CX principle: Use plain language

Being unemployed can be a very stressful time for individuals, especially as they grapple with financial insecurity and the pressure to find suitable work. Some claimants forget to initially certify for benefits while other claimants fail to follow through with required weekly certification tasks. In some cases, claimants remember to certify initially but pause when they reach a question that is difficult to answer and in doing do, miss the certification window altogether. Here are some methods states can use to remind claimants to complete their certification tasks in a timely manner.

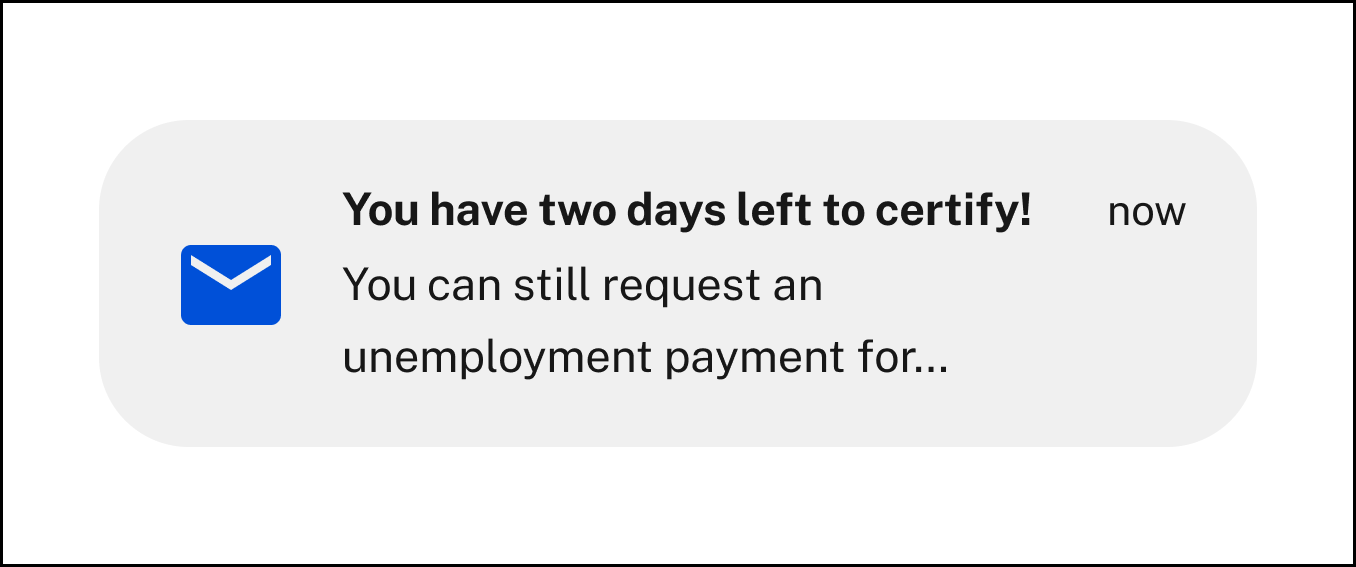

- Use email messages or text notifications for certification reminders. Refer to the example provided.

- Automate the distribution of reminders so they are sent at specified dates/times (e.g., at the start of certification process and then again before an individual’s certification window closes).

- Provide ample time windows for claimants to certify so they can complete these tasks at a time that is convenient for them.

Recommendation #2: Help claimants successfully navigate certification tasks by incorporating functionality that clearly indicates which week they are certifying for and allows them to refer to past weeks when providing their responses

Providing visibility into the weekly certification process can go a long way in helping claimants complete certification tasks. When information is presented in a way that aligns with claimants’ thought process and then broken down into easily recognizable concepts, claimants can feel confident they have answered the questions properly and met their weekly certification obligations. Here are some improvements states should consider to make the process clearer.

Include a calendar graphic to highlight the specific week the certification questions pertain to

Related CX principles: Use plain language; Provide contextual help

Claimants often struggle to understand which specific time period certification questions pertain to. Many claimants do not understand when a benefit week starts and ends for the purposes of unemployment insurance (e.g., Sunday to Saturday and not Monday to Friday) and inadvertently answer questions meant for a different week. Sometimes claimants answer “able and available” questions based on their current work availability rather than referring to the specific week outlined in the weekly certification. In other instances, claimants may struggle to accurately report earnings, especially if their past job paid wages for a different period than the state is requesting. Below are some interventions states can implement to help claimants accurately claim benefits for the week(s) in question.

- Include a calendar graphic that clearly highlights the specific week the certification questions pertain to. This “week at a glance” view minimizes confusion by guiding claimants to accurately select the week to certify for.

- When possible, add functionality so that a claimant is unable to enter information outside of the week (or weeks) they are certifying for.

- Use both visual design clues and text to guide claimants to the most likely and actionable next step. Highlight the dates a claimant should be certifying in both the calendar view and in the adjacent help text on the screen. Refer to screenshot provided.

Offer claimants personalized suggestions from week to week if possible

Related CX principle: Pre-populate when possible

When certifying for benefits, many claimants find themselves entering the same information week after week. Re-entering the same information repeatedly may prove not only time consuming, it could also result in accidental discrepancies over time due to simple human error. Enabling the state to store and carry over claimants’ answers would ensure accurate reporting and save claimants a significant amount of time.

- In addition to asking about any new types of income or employment, provide additional functionality that presents personalized suggestions based on prior weeks (e.g., an employer’s address or a type of reportable income like pension payments).

- Instead of allowing claimants to default to their previous answers, the personalized suggestions should be incorporated into the question prompts and not in the text fields themselves. Example: “Did you work for ABC Contracting during the week of March 17-23, 2024?” Refer to screenshot provided.

- Allow claimants to accept, not change, the suggestions presented to them to ensure they accurately answer the questions for that week.

Provide claimants with a record of their past certifications so they can accurately represent themselves in the event of a future appeal or audit

Related CX principle: Provide contextual help

Most claimants set out to answer weekly certification questions correctly but may struggle to find the proper information to do so, potentially resulting in mistakes. Providing access to past certifications for the life of a claim may support claimants in the event of a future appeal or audit process, especially if they have not kept a set of duplicative certification records.

- Provide additional functionality that allows claimants to view past certifications when needed.

- Take subsequent actions to mask or partially mask any personally identifiable information displayed in the interface to prevent fraud. These recommendations are also described in detail in the CX principles for online applications resource.

Recommendation #3: Provide specific income reporting guidance so claimants can accurately report wage earnings during the certification process

One theme that emerged from our conversations with state workforce agencies and claimant advocates is that many claimants find the wage information and work-related income questions to be particularly challenging. Many claimants do not understand what types of income must be reported or where to find the specific information being requested, while other claimants find the income terminology hard to understand. The following recommendations can help guide claimants who struggle with questions pertaining to income and wages.

Inform claimants they might be eligible to receive partial benefits for partial unemployment and show how the benefit amount is calculated

Related CX principles: Use plain language; Provide contextual help

Wage earnings are often misreported in UI weekly certifications. Part of the reason may be that many claimants are unaware they can still receive unemployment benefits while working part-time.

- Include specific language that individuals may be eligible to receive partial unemployment benefits for partial employment. Refer to the screenshot provided.

- Provide contextual help on how to report any earnings incurred from part-time employment. For example, include information on how to report gross pay (wages earned before taxes and deductions) or how to account for tips and overtime.

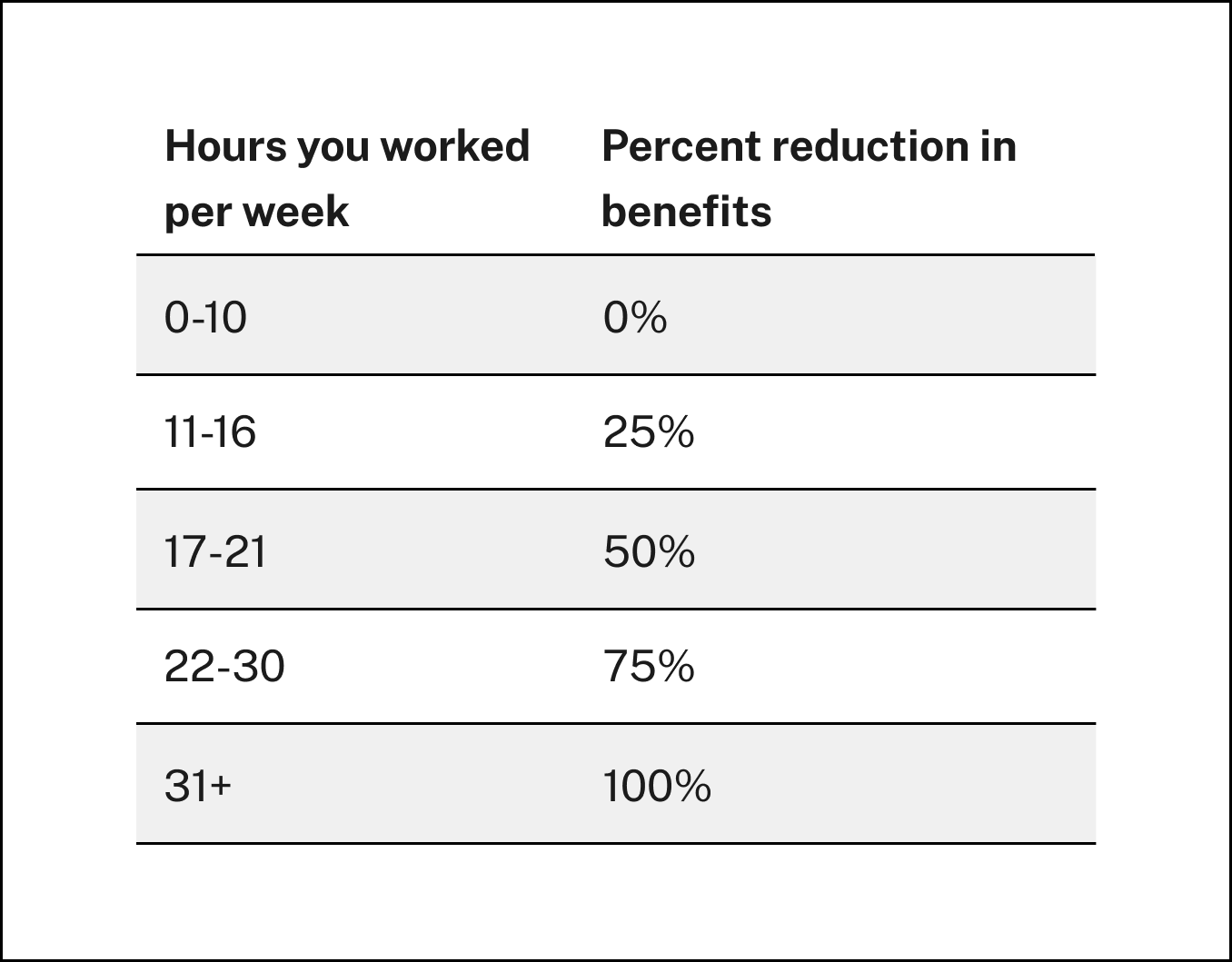

- Use a table or chart to illustrate how the partial benefit amount is calculated. Refer to the example screenshot provided.

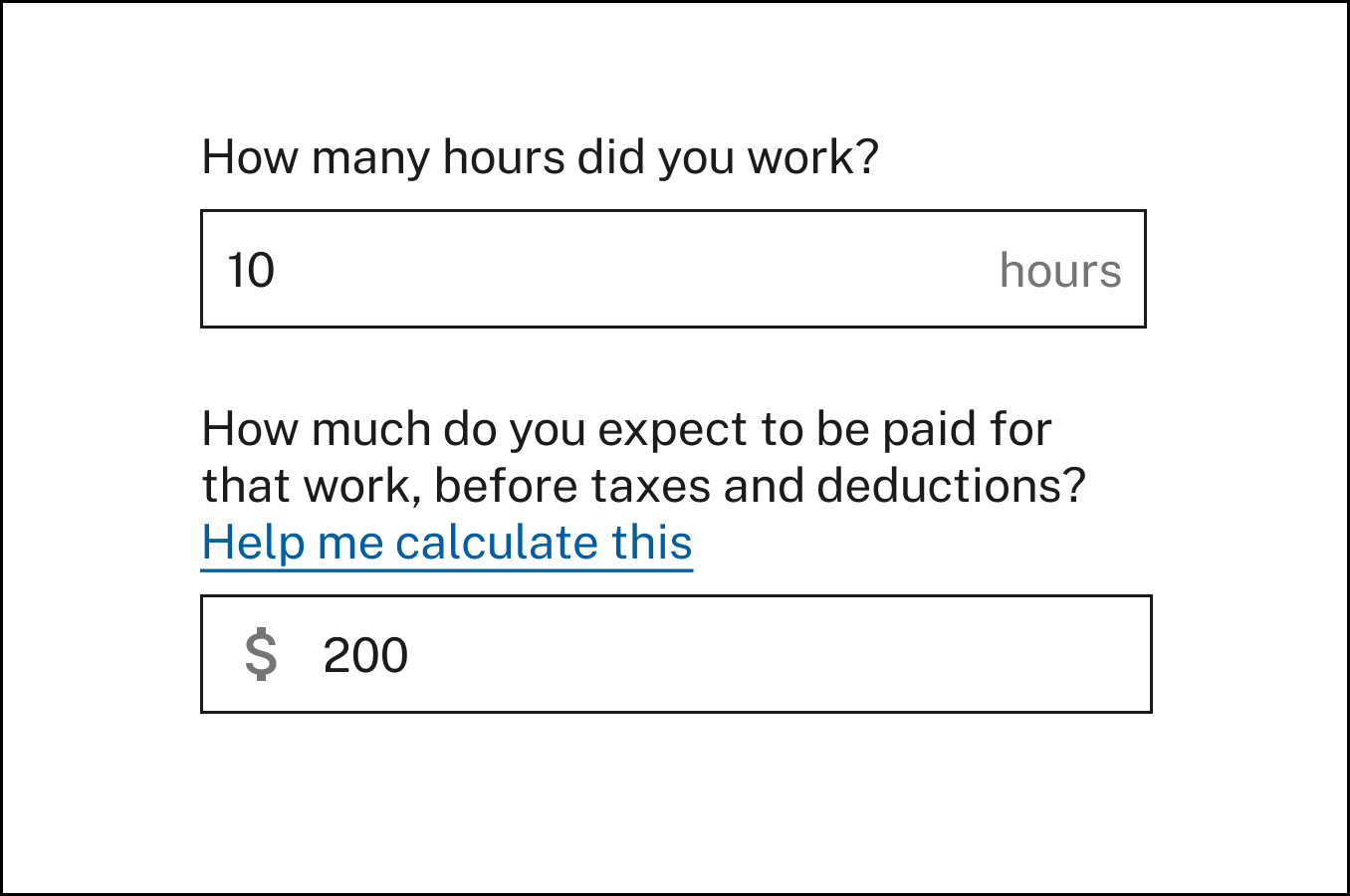

Provide an optional wage calculator to assist claimants in calculating past wages accurately

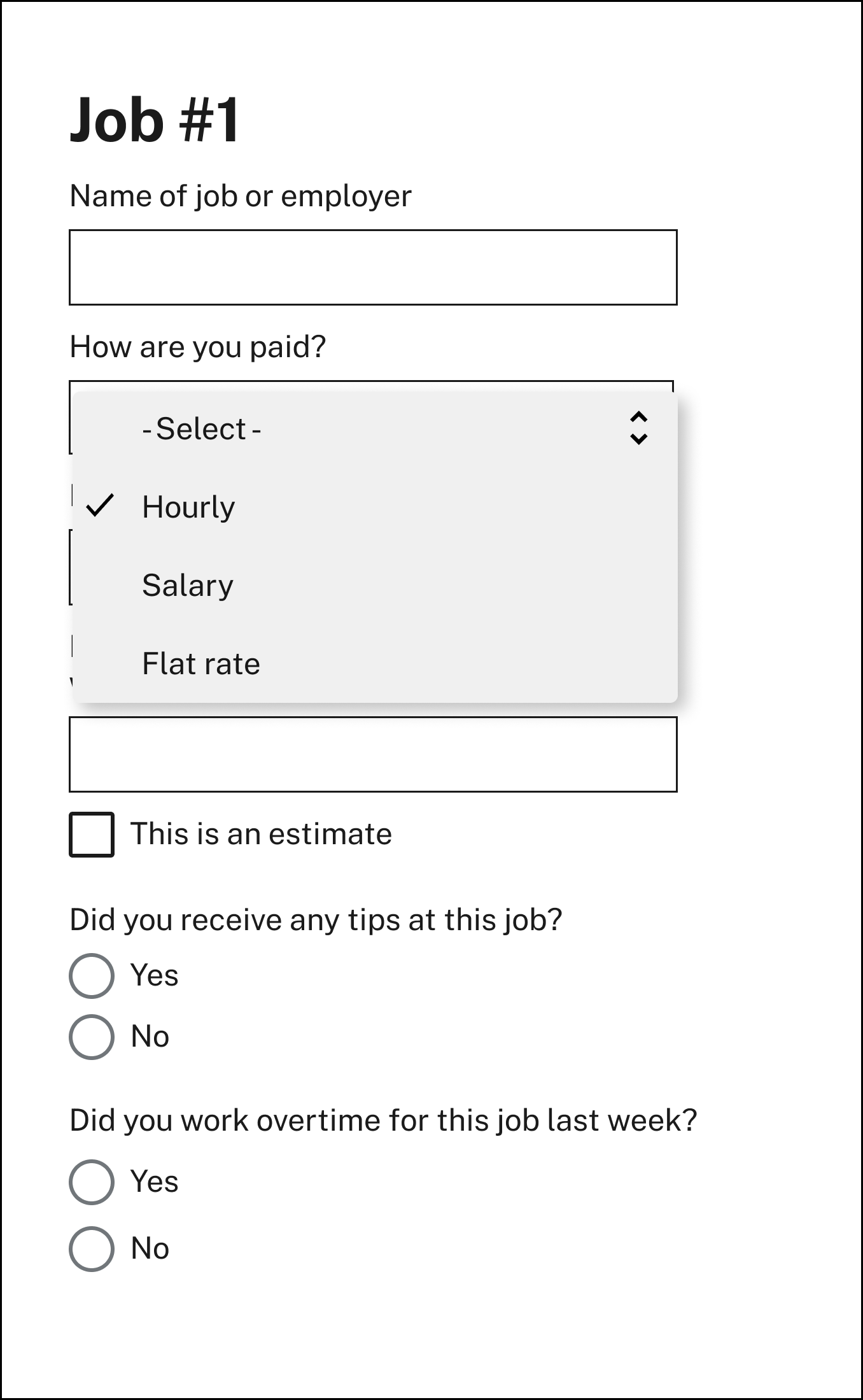

Claimants with wages that are more difficult to calculate (e.g., salaried individuals, those receiving commission or tips, claimants who have worked overtime or have performed flat rate work or those who have worked more than one job) often need help in calculating their wages. Often, claimants do not have a paystub to refer to or the pay period they are referencing does not match the period covered by the weekly certification. Math errors when calculating income are also quite common. Including an optional wage calculator can help reduce errors and simplify this step for claimants. Refer to the screenshot provided.

Add contextual help and follow-up questions to aid claimants in answering income-related questions accurately

Related CX principles: Use plain language; Provide contextual help

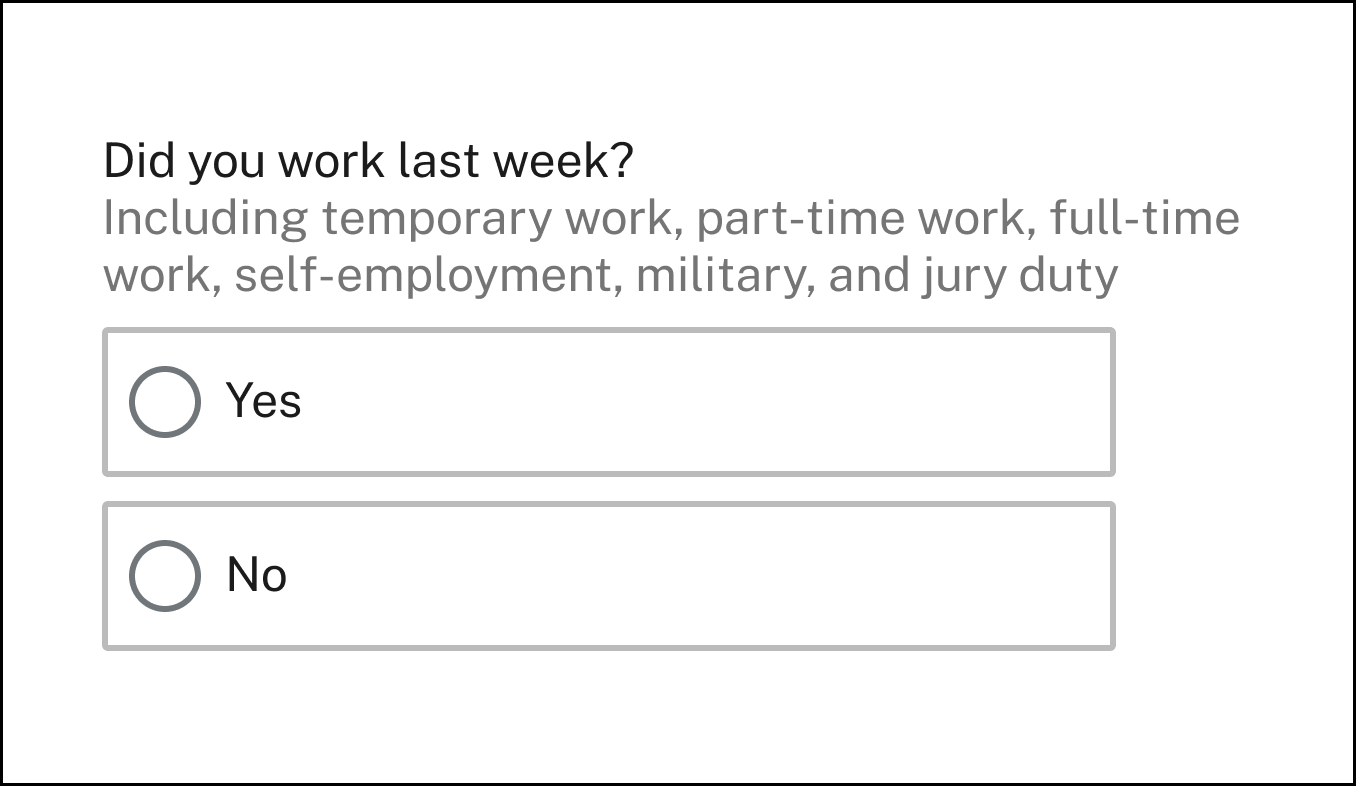

For work-related wages that are expected to be reported when earned, such as full-time work or hourly wages, ask a series of follow-up questions such as:

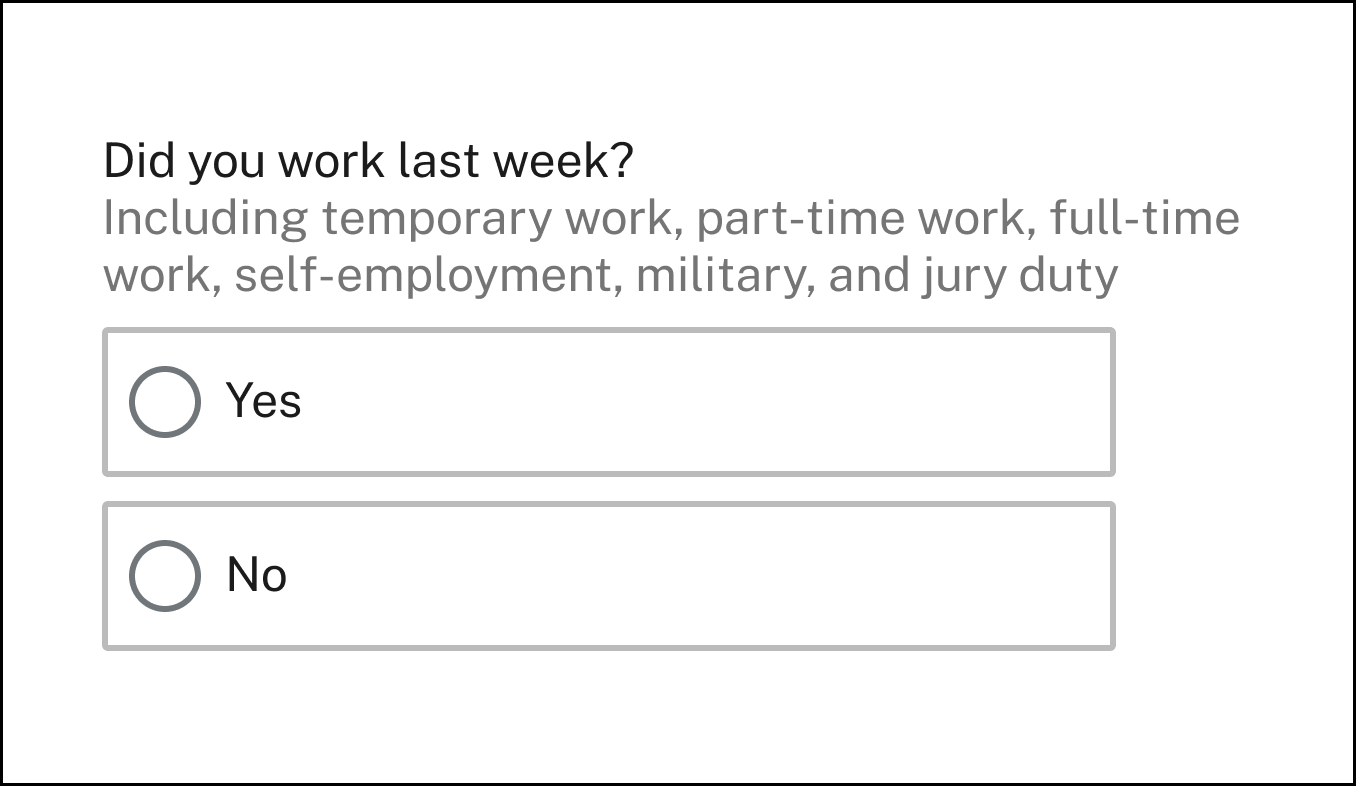

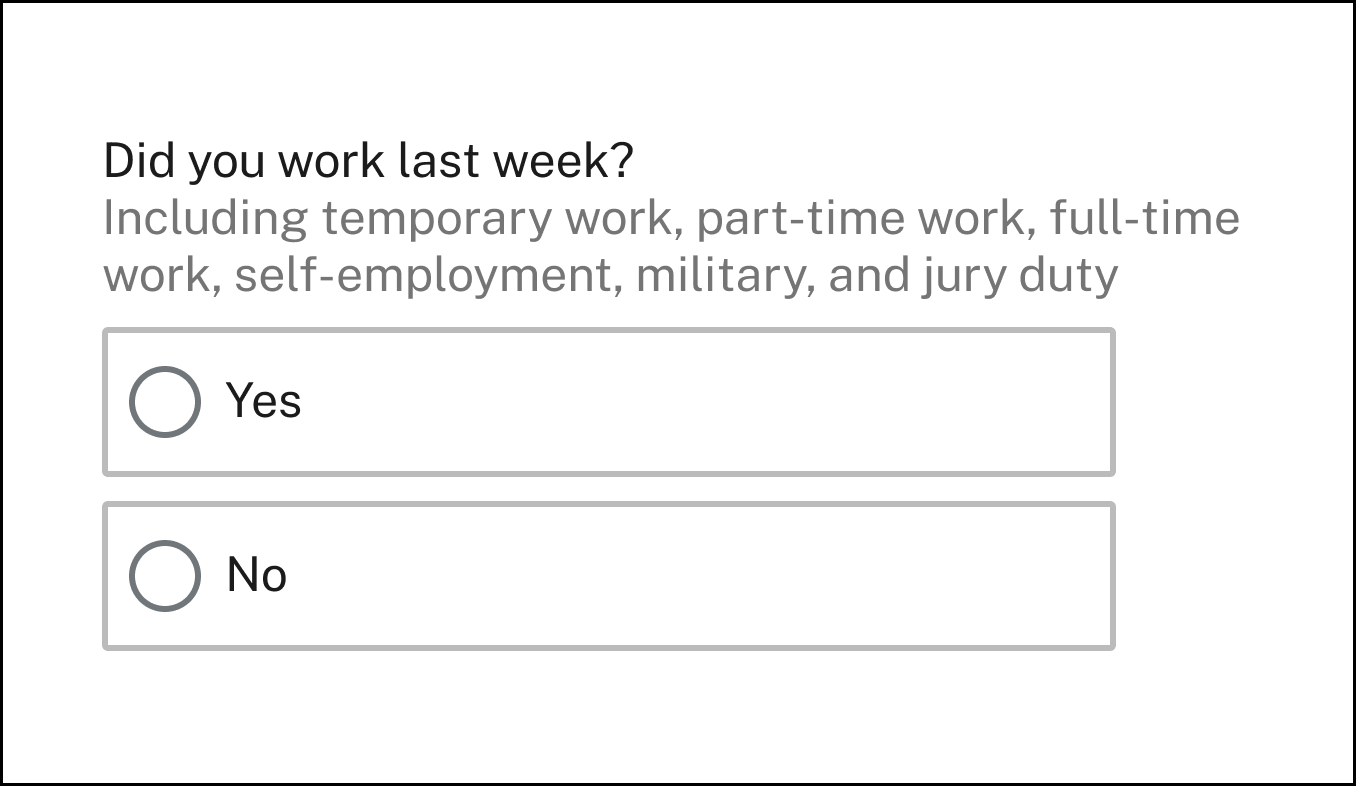

- “Did you work last week?” Note: States should clarify what qualifies as work, e.g. part-time work, full-time work, self-employment, military, or jury duty.

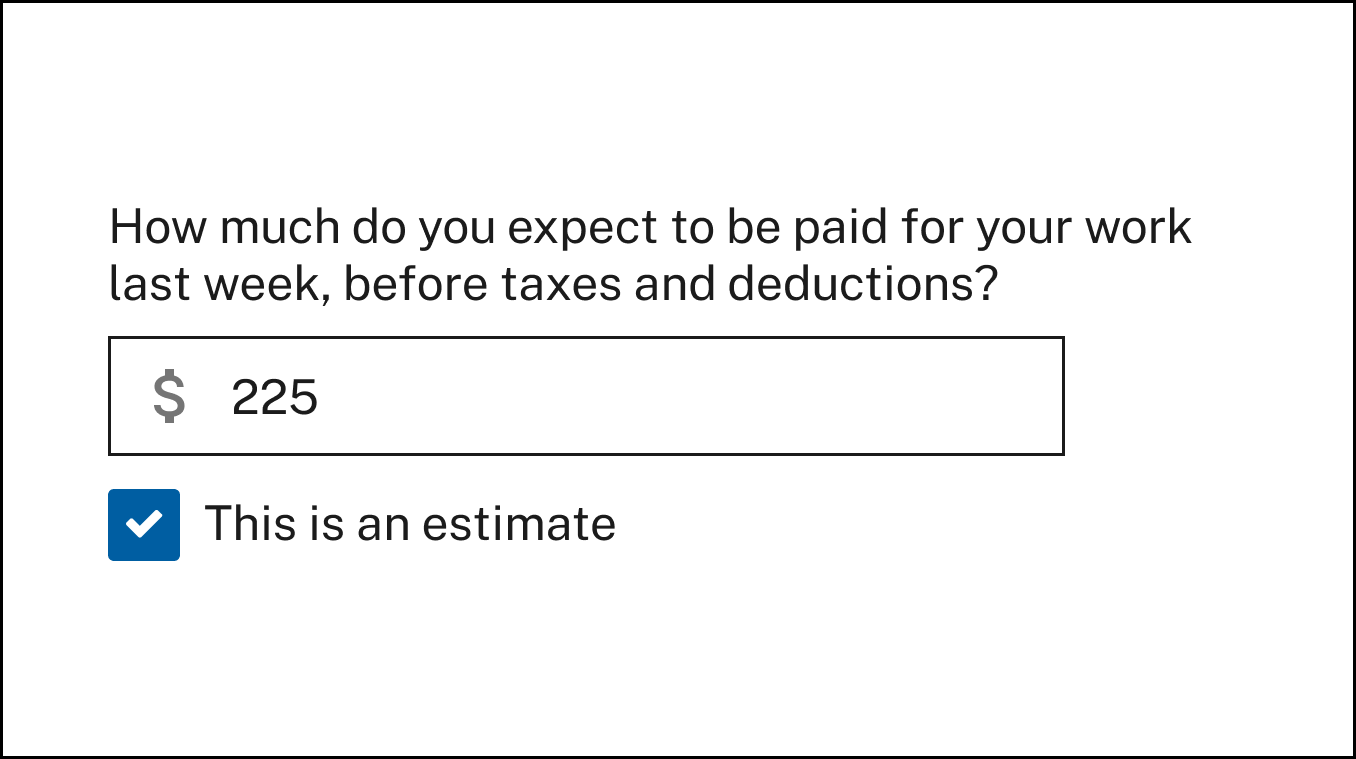

- “How much do you expect to be paid for that work before taxes and deductions?” Note: Individuals are often confused about reporting work done prior to being paid. States should ensure the wording of this question is about expected payment.

- Use plain language help text to define gross wages. Specify that these wages must be reported during the week they were earned (not received) and that a prior paycheck stub can help claimants locate past gross earnings.

Allow claimants to indicate when they are entering an estimate

When claimants do not have access to their paystub or are unsure of their exact earnings, entering an estimation is sometimes the only option for reporting wages that they have. Those who provide an estimate, however, may worry about the potential fraud implications of inputting an incorrect amount while others may skip entering estimated earnings altogether to avoid any negative legal repercussions. Although providing this option may result in additional fact-finding by the state or require the claimant to update their certification later with the correct information, giving claimants the option to provide an estimate is not only a good CX principle, it also could save states time in the long run since it could greatly reduce the number of cases to potentially adjudicate. This practice also provides flexibility for workers whose paychecks are reduced by an employer. Paychecks can be reduced for any number of reasons, such as an extra 401(k) plan deduction, or in unfortunate cases, a failure to comply with wage and hour laws and/or retaliation against employees who file complaints.

- Add a checkbox feature for individuals to indicate the amount they have entered is an estimate.

- Include help text to inform claimants of the potential consequences for inaccurate income reporting. Example: “Remember, if you estimate too low and are paid more in benefits than you should have received, you may have to pay back money. If you estimate too high and you are owed money, the state will pay you the amount owed.

- Allow individuals to correct their estimates at a later date, once they have the necessary information to do so.

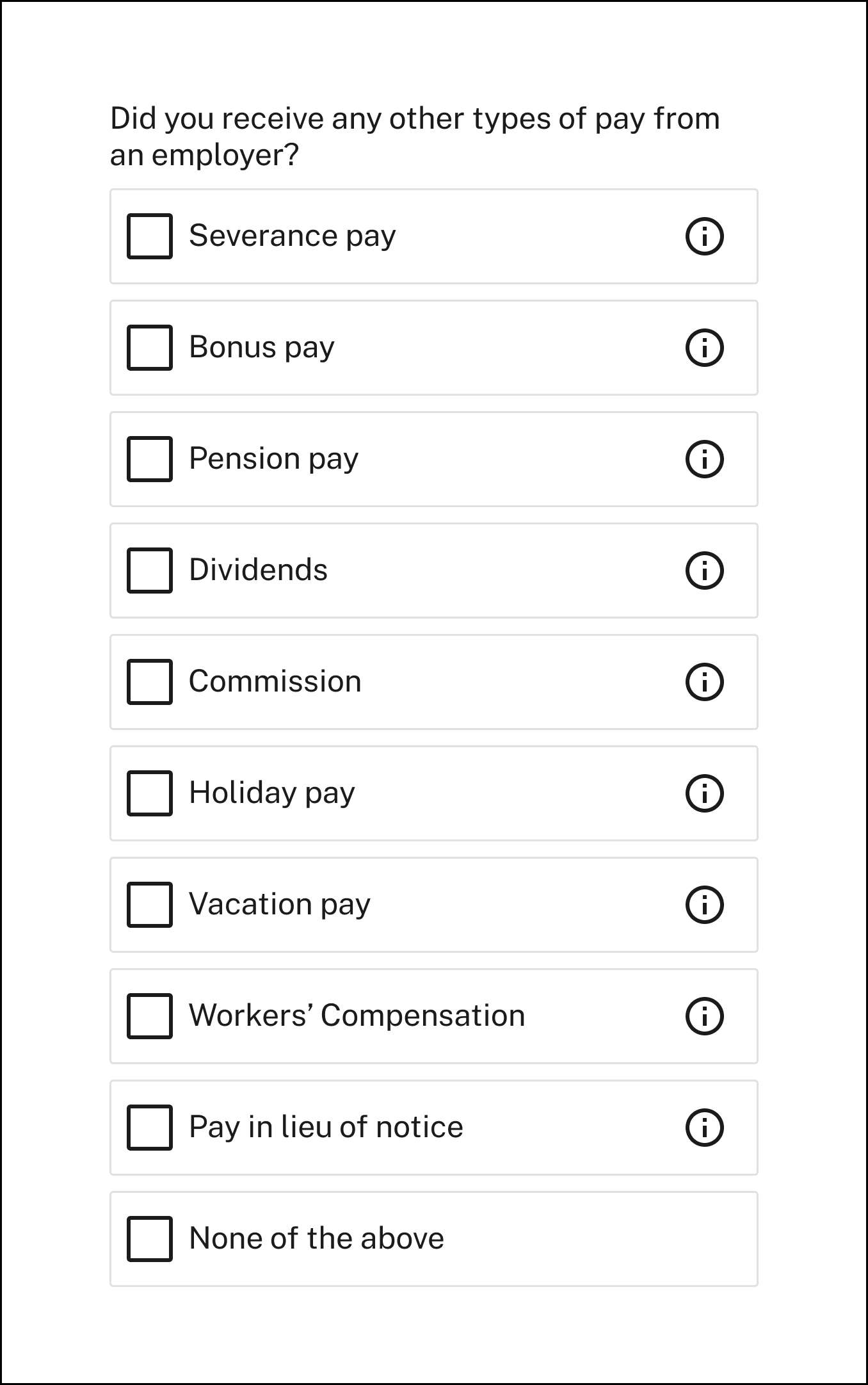

Include a complete list of income categories so claimants can easily select all that apply

Related CX principles: Use plain language; Provide contextual help

- For income that is expected to be reported when it is paid, such as bonuses or severance pay, provide claimants with a complete list of other types of reportable income so they can easily select all that apply. Refer to the screenshot provided.

- Add help text to provide additional context for each type of pay listed.

- If a claimant checks off one or more income types, consider using dynamic fact-finding and follow-up questions to capture additional information, if needed. For example, if the claimant indicates they are receiving severance, ask questions about the period the severance covers and whether it is received in a lump sum or in scheduled payments. Similarly, if the claimant indicates they are receiving pension payments, ask for employer details. Capturing this additional information may prove helpful in a future review/adjudication process.

Recommendation #4: Provide ample context and clarity when posing able and available questions so claimants can answer them accurately

Claimants often misunderstand the intent of able and available questions in ways that result in erroneous disqualification for UI benefits. Some assume the questions are asking about 24/7 availability or presume the information being requested pertains to a previous job. Systemic barriers to equitable access may also exist. For example, some individuals with disabilities might be able to work and eligible to receive UI benefits, but questions about ability may confuse and result in responses that incorrectly disqualify these workers. For more information and guidance on this, visit https://www.dol.gov/agencies/eta/advisories/uipl-01-21. Below are several interventions that may help states reliably capture able and available information from claimants.

Be clear and upfront about the intent behind able and available questions.

- Inform claimants that able and available questions are used to determine eligibility. Include specific language on what criteria determine someone’s eligibility for unemployment benefits. For example, that the person must be able to perform suitable work, be available for suitable work, and looking for suitable work for every week they are paid benefits.

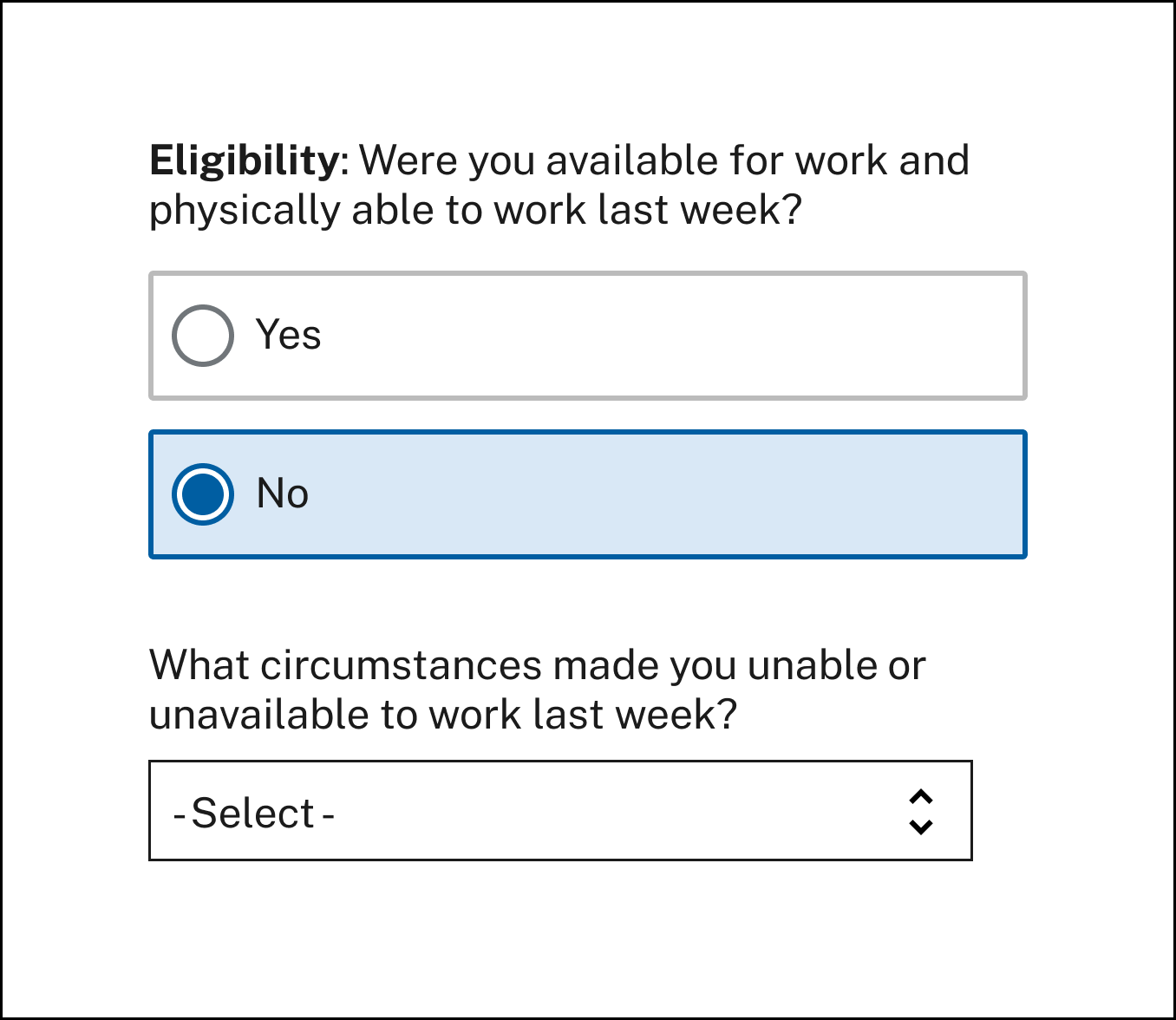

- Add language so claimants understand that these questions are tied to a specific week. Refer to the sample screenshot provided.

Use dynamic fact-finding to accurately capture whether a claimant is able and available for suitable work

There are many ways to misinterpret the able and available questions that are asked during the certification process. In fact, many who are actually able and available to take on work mistakenly compromise their eligibility for a given week by misinterpreting the scenarios provided. Many claimants we spoke with also didn’t differentiate between being able and available and instead chose to answer these two separate questions in the same way. For example, claimants could not imagine a scenario where they were out of the country and unavailable but “physically able” to work, or were too sick to work but “available for work.” Here are some specific strategies states can implement to accurately determine whether the claimant is able and available for employment.

- If a claimant answers “no” to able and available questions, use dynamic fact-finding and follow-up questions to determine whether the claimant was able and available to work during the certification period. Try to address as many common misunderstandings in these closed-ended follow-up questions as possible. Note: These questions are not meant to be shown to everyone, only to those claimants with a potential eligibility issue.

- In more rare situations where a determination can’t be made based on the answers to the closed-ended questions, ask specific open-ended questions to obtain any information the state needs to make an eligibility determination.

- Provide an open text field with a character limit so claimants can provide a reason for their inability to seek or accept work. Do not show an open-ended text field to all individuals. Instead, consider providing the option of entering explanatory text only to those who can’t prove they are able and available through other means.

- Even when using closed-ended, dynamic follow-up questions, a potential eligibility issue that may result in a denial must be reviewed by merit staff of the agency so that the claimant has a chance to clarify any inadvertently incorrect answers.