Fact Sheet #39H(b): Limitations on the Payment of Subminimum Wages for All Employees under Rehabilitation Act Section 511

This fact sheet provides general information about the impact of section 511 of the Rehabilitation Act of 1973 (section 511) on the payment of subminimum wages (SMWs) to workers with disabilities under section 14(c) of the Fair Labor Standards Act (FLSA). Section 511 limits the ability of employers to pay SMWs to workers with disabilities, when the employer holds a certificate under section 14(c) that would otherwise allow the payment of such wages. These limits are designed to ensure that workers who are paid SMWs under section 14(c) have access to necessary support and resources. Importantly, an employer that has not complied with the requirements of section 511 does not have authority to pay SMWs to workers with disabilities under section 14(c).

Section 511 requires that all workers with disabilities, of any age (including a youth with a disability), receive regular career counseling and information about self-advocacy, self-determination, and peer mentoring training opportunities in their local area. Employees must receive these services twice in the first year they are hired at SMWs and at least one time every year after. Such requirements help ensure that workers receive critical information and services in a timely fashion, which helps maximize opportunities to obtain competitive integrated employment. These requirements are in addition to, and do not replace, the requirements of section 14(c). Please see Fact Sheet 39H for general information about section 511 and Fact Sheet 39H(a) for more information about youth with disabilities age 24 or younger.

Two Requirements for Employees Paid SMWs

1. Career Counseling, and Information and Referrals (CCIR)

Section 511 does not allow employers to pay SMWs to a worker with a disability, of any age, unless the employee has received CCIR from the designated state unit (DSU) every year. However, during the employee’s first year receiving SMWs, the employer must review and verify CCIR was received twice—once in the first six months after hire and again during the second six months after hire. The DSU, which is the vocational rehabilitation (VR) agency in the State, is required to provide the CCIR. It must also provide each employee with a document showing that they completed CCIR as soon as possible after the services are provided, but usually no later than 45 calendar days.

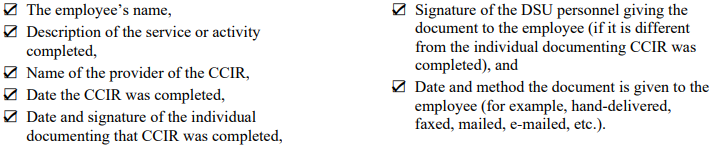

Employers should expect to see all of the following information on the DSU document:

When employers review the document, if they have questions about the information (for example, if the document is missing the information listed above) they should ask the DSU for an updated or corrected document.

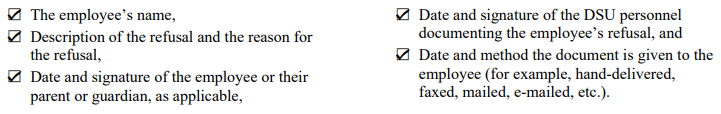

If a worker with a disability, or the worker’s parent or guardian, refuses to participate in CCIR through informed choice, the DSU document must contain the following information:

Note: If an employee refuses to participate in CCIR, the DSU must provide the document to the employee within 10 calendar days of their refusal. The employer is not permitted to pay SMWs to an employee who refuses to participate in CCIR.

2. Information about Self-advocacy, Self-determination, and Peer Mentoring Training Opportunities

Section 511 does not allow employers to pay SMWs to a worker with a disability, of any age, unless the employer informs the employee about training opportunities in the local area where they can learn about self advocacy, self-determination, and peer mentoring. The employer should provide information about all three of these topics, but any single training opportunity does not have to address all the topics. The information should be enough that the employee could contact the organization about their services if they wanted to do so. For example, the employer should provide at least the organization name, address, website, and/or telephone contact information, name of the person to contact, and a description of the training opportunities provided by the organization.

The training opportunities may be from a variety of sources, including under a Federal or State program. The training opportunities cannot be provided by anyone that has any financial interest in the employee’s future job choice, including an employer who has a section 14(c) certificate. The employer may not provide its own training on these topics to meet this requirement. The employer must instead provide information about training offered by other appropriate programs or sources.

Small business exception: Employers with fewer than 15 total employees may satisfy the training opportunities requirement by referring their employees paid SMWs to the DSU to receive the information about training opportunities. The 15-employee count should include all employees of the employer, both staff and workers with disabilities.

Timing of CCIR and Training Opportunities

Employees hired before July 22, 2016 – Section 511 does not allow employers to pay SMWs to employees who were hired at SMWs before July 22, 2016 (“grandfathered” employees) unless the employees receive CCIR and information about training opportunities each year. These employees must receive these services before July 22 of each year. The services can be received at any time from July 22 in one year through July 21 the next year. CCIR and the information about training opportunities do not need to be received on the same day and do not have to be at the same time from year to year.

Example: Ibrahim was first hired at SMWs in 2015. Because he was hired before July 22, 2016, Ibrahim needs to have CCIR and receive information about training opportunities only once each year. Ibrahim’s employer coordinates with the DSU to provide him CCIR during the middle of June each year. The employer provides him with information about training opportunities during the first week of July each year. If Ibrahim received both services each year and the employer reviewed the CCIR documents and provided the information about training opportunities, the employer would meet both section 511 requirements. If, however, Ibrahim is absent on the day that the DSU provides CCIR, his employer should coordinate with the DSU to make sure he receives CCIR before the July 21 deadline for that year. If Ibrahim does not receive the mandatory CCIR, the employer would not be permitted to pay him SMWs after July 21 until he receives the CCIR.

Employees hired on or after July 22, 2016 – Employees receiving SMWs who were hired on or after July 22, 2016 must receive CCIR and information about training opportunities twice during their first year—once in the first six months after hire and again during the second six months after hire—and again annually during every year that the employee is paid SMWs. The deadline for these employees to receive services is based on the anniversary of their hire date at SMWs with the employer. Like the grandfathered employees, the services can be received at any time during the six-month or one-year period, do not need to be received on the same date, and do not have to be provided at the same time from year to year. The deadline for these employees remains the same even if the services are received at different times during the year.

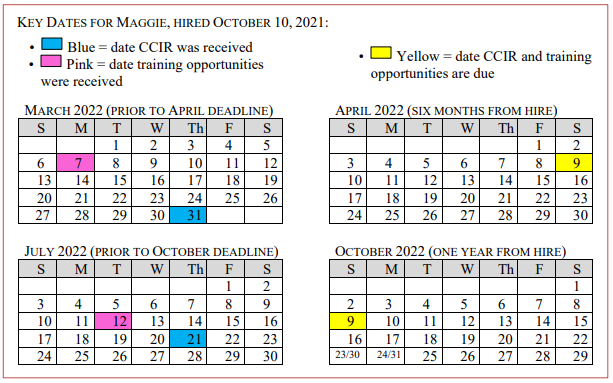

Example: Maggie was first hired at SMWs on October 10, 2021. Maggie is required to receive CCIR and training opportunities in her first six months (October 10, 2021 – April 9, 2022), again during her second six months (April 10, 2022 – October 9, 2022), and every year (October 10 to October 9 the next year). Maggie receives CCIR on March 31, 2022, July 21, 2022, and annually during July (prior to October 9). Maggie is informed by the employer of training opportunities on March 7, 2022, July 12, 2022, and annually during July (prior to October 9). In this example, Maggie’s employer made sure she received all the required services before the deadlines. Sample calendars, provided below, illustrate how to determine if all services have been timely provided.

Keeping Records for the CCIR and Training Opportunities Information Requirements

CCIR – Employers must review and verify that everyone paid SMWs has received CCIR before their deadline. Employers are strongly encouraged to keep copies of the document(s) that the DSU provides to each employee when they complete CCIR.

Training Opportunities Information – Employers must provide training opportunities information to each employee paid a SMW before the employee’s deadline. Employers do not have to use a specific method to document that they have done so. Here are a few best practices employers may follow:

- The employer holds individual meetings with all workers every six months to tell them about appropriate training opportunities and give them the information in writing. (The employer could also use this meeting to discuss the worker’s other training or support needs.) The employer has each employee sign a document that states the employee received the training opportunity information and that the employer discussed it with them.

- Once every six months, the employer invites a local non-profit organization to give a presentation about training opportunities in self-advocacy, self-determination, and peer mentoring available in the local area. The employer then provides each employee with a flyer with a summary of the training opportunity information that was presented and uses an employee sign-in sheet to track and ensure that all employees paid SMWs attend the presentation.

Use of Documents by Multiple Employers

CCIR – The DSU must provide documents that show CCIR has been completed to the worker who receives the services. The worker’s employer is responsible for reviewing and verifying these documents showing that CCIR was provided timely before continuing to pay SMWs. The original documents belong to the worker, and if they decide to start a new job, the worker can show the documents to another employer.

Training Opportunities – Each employer is responsible for providing information about self-advocacy, self determination, and peer mentoring training opportunities to their own employees timely. Employers cannot use information provided by a former employer to comply with this requirement.

Where to Obtain Additional Information

For additional information, visit our Wage and Hour Division Website: http://www.dol.gov/agencies/whd and/or call our toll-free information and helpline, available 8 a.m. to 5 p.m. in your time zone, 1-866-4USWAGE (1-866-487-9243).

This publication is for general information and is not to be considered in the same light as official statements of position contained in the regulations.