Below you will find answers to frequently asked questions about Federal contractor reporting requirements and affirmative action obligations under the Vietnam Era Veterans' Readjustment Act of 1974 ("VEVRAA" or "Section 4212"), 38 U.S.C. 4212. The FAQs are arranged by subject area.

VETS-4212 Federal Contractor Reporting

Federal Contractor Reporting Requirements

What are my company’s VETS-4212 Reporting Requirements?

VEVRAA requires Federal contractors and subcontractors covered by the Act's affirmative action provisions to report annually to the Secretary of Labor the number of employees in their workforces, by job category and hiring location, who are qualified covered veterans (38 U.S.C. 4212(d)). VEVRAA also requires Federal contractors and subcontractors to report the number of new hires during the reporting period who are qualified covered veterans. The Veterans' Employment and Training Service (VETS) has issued regulations found in 41 CFR part 61-300 to implement the reporting requirements under VEVRAA.

- The regulations in 41 CFR part 61-300 implement the Jobs for Veterans Act (JVA) amendments to the reporting requirements under VEVRAA and require the annual submission of the Federal Contractor Veterans' Employment Report VETS-4212.

All nonexempt Federal contractors and subcontractors with a contract or subcontract in the amount of $150,000 or more with any department or agency of the United States for the procurement of personal property or non-personal services.

"Government contract" is defined as any agreement, or modification thereof, between any person and a department, agency, establishment or instrumentality of the United States Government for the purchase, sale, or use of personal services and non-personal services (including construction). The term "Federal contract" is also used in these Frequently Asked Questions, and has the same meaning as "Government contract."

Each year starting August 1st and going through September 30th all contractors and subcontractor that have contracts that meet the requirement for submitting reports must file a report during the official "Filing Cycle" following a calendar year in which a contractor or subcontractor held a contract or subcontract.

"Filing Cycle" is the time period from August 1 through September 30 when reports are required to be submitted by all contractors and subcontractors who have contracts that meet the requirements for reporting.

When submitting your report(s) you need to choose a pay period ending date that is between July 1 and August 31. This will be the date that is used to create a snapshot of your companies hiring information.

A bank is covered under VEVRAA if it has a single contract that meets the $150,000 threshold amount for coverage. Federal contracts held by banks and other financial institutions include, but are not limited to, agreements to serve as fund depository and agreements for federal share and deposit insurance.

No. The reporting requirements under VEVRAA apply only to Federal contractors that are subject to the affirmative action provisions of VEVRAA. The reporting requirements do not apply to an agency or subdivision of a State or local government that does not participate in work on or under a Federal contract or subcontract.

A contractor may stop filing the VETS-4212 Report when it no longer has a Federal contract or subcontract covered by the VETS-4212 reporting requirement.

Federal Contracting Officers (CO / KO) are prohibited from expending or obligating funds or entering into a contract with a contractor that was subject to reporting requirements under VEVRAA but did not submit a Report for the previous fiscal year (31 U.S.C. 1354).

The U.S. Secretary of Labor provides a database available to Federal Contracting Officers (CO / KO) of Federal contractors and subcontractors that filed the previous year's report. Federal Contracting Officers may also contact the VETS-4212 Customer Support Center at 1-866-237-0275 or vets4212-customersupport@dolncc.dol.gov.

Regulations are available at:

41 CFR part 61-300 –

https://www.federalregister.gov/documents/2014/09/25/2014-22818/annual-report-from-federal-contractors

How does my company complete its VETS-4212 Report?

The VETS-4212 Reports must be submitted no later than September 30 of each year following a calendar year in which a contractor held a covered Government contract or subcontract.

You may download the VETS-4212 Report from our website at https://www.dol.gov/agencies/vets/programs/vets4212

Yes, you are encouraged to file electronically. Please visit the VETS-4212 website at https://www.dol.gov/agencies/vets/programs/vets4212 to submit the VETS-4212 Report(s) electronically.

Reports for the reporting cycle may be filed between August 1 and September 30.

Further information is available by contacting the VETS-4212 Customer Support Center at 1-866-237-0275 or vets4212-customersupport@dolncc.dol.gov.

To determine the "reporting period" for the purposes of completing the VETS-4212 Reports, the contractor must first select a date in the current year between July 1 and August 31 that represents the end of a payroll period. The 12-month period proceeding the selected payroll period ending date is the 12-month reporting period.

For example, if a Federal contractor or subcontractor selects a pay period that ends on July 20 and the employer’s pay period covers a two-week period. The employer counts the new hires during the previous 26 pay periods (52 calendar weeks) and reports the total amount of employees at the end of the July 20, pay period. The employer reports the maximum and minimum number of employees during the 26 pay periods over the 52 weeks.

A contractor that has approval from the Equal Employment Opportunity Commission to use December 31 as the ending date for the EEO-1 Report may also use December 31 as the ending date for the payroll period selected for the VETS-4212 Reports.

The term "parent company" refers to any corporation which owns all or the majority stock of another corporation so that the latter stands in relation to it as a subsidiary.

"Hiring location" has the same definition as "establishment," which is defined in the instructions for completing the EEO-1 Report. It means an economic unit which produces goods or services, such as a factory, office, store, or mine. In most instances, the establishment is a single physical location engaged in one, or predominantly one, economic activity (41 CFR part 61-300.2(b) (1)).

Single-establishment employers must file the VETS-4212 Report. Multi-establishment employers file for the headquarters office and for each hiring location employing 50 or more persons. If the multiple establishment hiring locations within a state employ fewer than 50 persons, the employer can file separate reports for each location, or state consolidated reports that cover all hiring location.

The North American Industry Classification System (NAICS) is the standard used by federal statistical agencies in classifying business establishments for the collection, analysis, and publication of statistical data related to the business economy of the United States. NAICS was developed under the auspices of the Office of Management and Budget (OMB), and adopted in 1997 to replace the old Standard Industrial Classification (SIC) system.

You may access various NAICS reference files and tools at the official U.S. federal website, https://www.census.gov/naics/.

The official 2022 U.S. NAICS includes definitions for each industry, background information, tables showing changes between 2007, 2012, 2017, and 2022, and a comprehensive index. The official 2022 U.S. NAICS Manual is available in print and on CD-ROM from the National Technical Information Service (NTIS) at 1-800-553-6847 or 703-605-6000, or through the NTIS website. Previous versions of the NAICS Manual are available.

The DUNS Number is a nine-digit business identifier that is assigned and maintained by Dun and Bradstreet. The DUNS Number is the standard for all federal electronic commerce transactions and is used as the contractor identification code for all procurement-related activities. The DUNS Number uniquely identifies a single business entity, while linking the corporate family structure. Employer submission of this number will assist VETS in identifying Federal contractors and subcontractors.

Federal contractors may request a DUNS Number at no cost via the website, https://www.dnb.com/duns/get-a-duns.html?search, or by contacting the D&B Federal Customer Response Center: U.S. and U.S Virgin Islands: 1-866-705-5711; Alaska and Puerto Rico: 1-800-234-3867. Additional information about the DUNS number can be found at the following website: https://www.dnb.com/.

The Employer Identification Number (EIN) is assigned by the Internal Revenue Service to all employers. The EIN assists VETS in correctly identifying the contractors that are to be included in our Federal contractors' database and verifying submission of required reports. The EIN also assists VETS in updating and maintaining a current database, including removal of employers who are no longer required to submit the VETS-4212 Report.

Federal Contractors may learn about obtaining an EIN on the Internal Revenue Service's website.

The VETS-4212 Report categories are simply "Protected Veterans'" as defined by the following categories:

(1) Disabled veterans;

(2) Active duty wartime or campaign badge veteran;

(3) Armed Forces service medal veterans (veterans who, while serving on active duty in the Armed Forces, participated in a United States military operation for which an Armed Forces service medal was awarded pursuant to Executive Order 12985); and

(4) Recently separated veterans (veterans within 36 months from discharge or release from active duty).

Information on the wars, campaigns, or expeditions for which a campaign badge has been authorized may be found on the following website, https://www.opm.gov/policy-data-oversight/veterans-services/#url=Vet-Guide.

The following website has information about the Armed Forces service medal: https://www.fedshirevets.gov/job-seekers/special-hiring-authorities.

Generally, the term "employee" for the purposes of the VETS-4212 reporting means any individual on the payroll of an employer who is an employee for the purposes of the employer's withholding of Social Security withholding. The term “employee” does not include persons who are hired on a casual basis for a specified time, or for the duration of a specified job (41 CFR part 61-300.2 (b) (2)). When completing the VETS-4212 Reports the contractor is to provide data for the number of permanent full-time and part-time employees who belong to the specified categories of veterans along with the total number of employees, both veterans and non-veterans, as of the ending date of the selected payroll period.

A "new hire" is a regular full-time or part-time employee who is hired during the reporting period, which is the 12-month period preceding the ending date of the selected payroll period. When completing the VETS-4212 Reports the contractor is to provide data on the total number of new hires, both veterans and non-veterans, and the number of new hires who belong to the specified categories of veterans.

The "maximum" number of employees is the greatest number of employees on board during the 12-month period covered by the report. The "minimum" number is the fewest number of employees on board during the 12-month reporting period.

Contractors and subcontractors and subcontractors are not required to survey their workforces to solicit information about veterans' status for the purpose of completing the VETS-4212 Report. However, a contractor is permitted to solicit information about veterans' status in any lawful manner.

For example, if the contractor periodically surveys its employees for the purpose of updating personnel records, the contractor could ask the employees to provide information regarding their veterans' status at that time.

Yes. Under the regulations implementing the affirmative action provisions of VEVRAA issued by the Office of Federal Contract Compliance Programs (OFCCP), a Federal contractor is required to invite applicants to inform the contractor whether he or she is a veteran belonging to one of the categories of veterans covered under VEVRAA who wishes to benefit under the contractor's affirmative action program (AAP) for covered veterans.

For further explanation of the invitation to self-identify requirements, see 41 CFR 60-300.42.

A Federal contractor still needs to file VETS-4212 report. Fill in the period covered, enter zeros in columns A, C & D, complete column B, enter maximum and minimum number of employees and submit the form electronically or return to the address indicated.

What are some examples of how to report veterans’ status on the VETS-4212?

NUMBER OF EMPLOYEES | NEW HIRES (PREVIOUS 12 MONTHS) | ||

|---|---|---|---|

PROTECTED VETERANS | TOTAL EMPLOYEES | PROTECTED VETERANS | TOTAL NEW HIRES |

When filing the VETS-4212 Report, she should be reported as an "employee" in Column (B) and as “new hire” in Column (D). She should not be reported as a “protected veteran” because she had been out of the service for more than three years when hired. Under VEVRAA, “recently separated veteran” means a veteran released from active duty in the U.S. military, ground, naval, or air service within the past 3 years.

NUMBER OF EMPLOYEES | NEW HIRES (PREVIOUS 12 MONTHS) | ||

|---|---|---|---|

PROTECTED VETERANS | TOTAL EMPLOYEES | PROTECTED VETERANS | TOTAL NEW HIRES |

When filing the VETS-4212 Report, she should be reported as an "employee" in Column (B) and should not be reported as a “protected veteran” because the employee has been out of the service for more than three years. Under VEVRAA, “recently separated veteran” means a veteran released from active duty in the U.S. military, ground, naval, or air service within the past 3 years

NUMBER OF EMPLOYEES | NEW HIRES (PREVIOUS 12 MONTHS) | ||

|---|---|---|---|

PROTECTED VETERANS | TOTAL EMPLOYEES | PROTECTED VETERANS | TOTAL NEW HIRES |

When filing the VETS-4212 Report, he should be reported as a “protected veteran” in Column (A). The contractor hired the veteran within three years of his release from active duty. The veteran should also be counted as a “new hire” in Column (C).

What are my company’s Affirmative Action Obligations under VEVRAA?

The affirmative action provisions of VEVRAA require covered contractors and subcontractors to take affirmative action to employ and advance in employment, qualified covered veterans 38 U.S.C. 4212(a). To implement the affirmative action requirement, VEVRAA and OFCCP’s implementing regulations require contractors and subcontractors to list most employment openings with an appropriate employment service delivery system. Each such employment service delivery system is to provide protected veterans priority referrals to such openings. Positions that will be filled from within the contractor's organization and positions lasting three days or less are exempt from this mandatory job-listing requirement. Listing employment openings with the State workforce agency job bank or with the local employment service delivery system where the opening occurs will satisfy the requirement to list jobs with the local employment service delivery system.

The U.S. DOL Office of Federal Contract Compliance Programs (OFCCP) OFCCP is responsible for ensuring compliance with requirement in VEVRAA that contractors list their employment openings with the appropriate employment service delivery system.

For additional information regarding compliance with the job listing requirement is available on the OFCCP website in the form of FAQs.

OFCCP enforces VEVRAA and its implementing regulations mainly through compliance evaluations and on-site visits, but also, at times, through complaint investigations. If a compliance evaluation or complaint investigation discloses evidence of a violation of VEVRAA and its implementing regulations, including a violation of the job listing requirements, the regulations require OFCCP to attempt conciliation with the contractor and to negotiate a conciliation agreement. Where voluntary compliance cannot be achieved, OFCCP may refer the matter to the Solicitor of Labor to institute formal, administrative enforcement proceedings, or refer the case to the Attorney General for the appropriate litigation. A contractor in violation of VEVRAA and its implementing regulations may have its contracts canceled, terminated, or suspended in whole or in part, and the contractor may be debarred, i.e., declared ineligible for future federal contracts.

Under OFCCP’s regulations implementing the affirmative action provisions of VEVRAA each contractor or subcontractor that has, (1) 50 or more employees, and (2) a Federal contract or subcontract of $150,000 or more, must prepare, implement, and maintain a written AAP for each of its establishments. 41 CFR 60-300.40.

Additional information regarding the AAP requirement is also available on the Office of Federal Contract Compliance Programs’ (OFCCP) website: www.dol.gov/ofccp/regs/compliance/faqs/vevraa_faq.htm

OFCCP's regulations implementing the affirmative action provisions of VEVRAA require contractors to include the clause in any subcontract or purchase order of $150,000 or more. 41 CFR 60-300.5(b).

Where can I find Veteran Employment Data on the web?

VETS-100/A: have expired and are no longer available

VETS-4212:https://developer.dol.gov/others/vets4212/

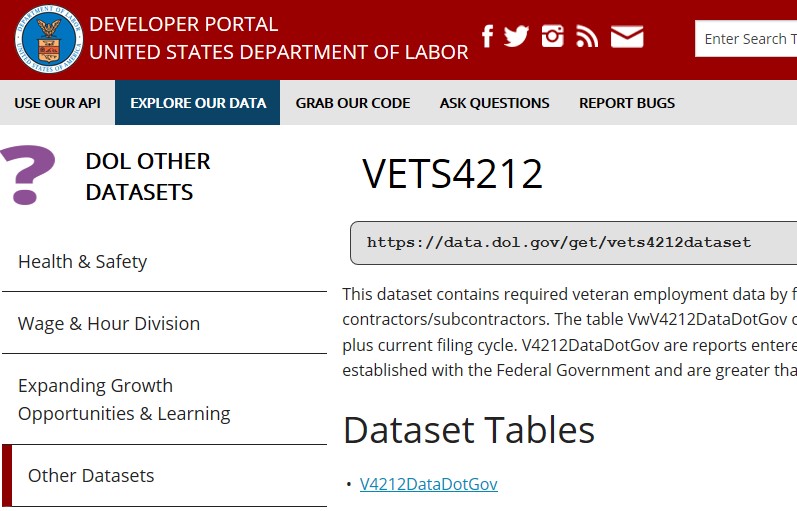

Following the VETS-4212 URL will open the DataDotGov catalog page that looks like figure 1. You will use the information on this page, later on, to craft the appropriate URL to retrieve data.

To access the data, you will need to use URL filtering and are limited to only 200 records at a time. The first thing you will need to do is create an account at https://devtools.dol.gov/developer/Account/Register figure 2, which you will use to create unique tokens to access the DOL public API. Once you have created an account, you will need to login by going to https://devtools.dol.gov/developer figure 3, enter your username and password and click "Log In."

Once you have logged into the public API in the upper right will be a link, "My Tokens." Click on this link to access your current tokens. The first time you enter, you will not have any tokens, so you will need to click on the link "Create New Token" in figure 4.

The shared secret is a long, complex password, don't worry about forgetting what you entered; you will be able to look up this information once you have completed creating the token. The application name is anything you would like, such as "VETS-4212 Data". The description allows you to define how the key will be used, such as "This token is to access the VETS-4212 application data." Once completed, click on the button "Create." which will take you back to the "My Tokens." Once back on this page, you will want to copy the "Token" value you just created because you will need to use it when accessing the data using the DOL API.

Now you have everything you need to start accessing the actual data from the DOL API. Remember the landing page I mention you will use later on in these instructions. Now is the time you will go to the URL https://developer.dol.gov/others/vets4212/ figure 6, to get two important pieces you will need when accessing the data. The first piece of information is the base URL; in the image, highlighted in yellow https://data.dol.gov/get/vets4212dataset. The second piece of information you will need is the name field columns you would like to query, as listed in the data dictionary, figure 7.

You will be combining these two pieces to create a URL that will return specific data. As an example, you want to get VETS-4212data, your URL will begin with https://data.dol.gov/get/vets4212dataset. The next item you will add to the URL will define the format (XML or JSON). We will be using special keywords with slashes "/" to create filter sections of the URL. To define the type of data returned add /format/xml or /format/json. The next part of the URL to add will define how many records to return; this is the limit. The maximum number of records that are allowed returned is 200, so we will add /limit/200. Due to returning only a limited amount of records each time, we will add an offset to provide the starting record to return. To define the starting record, we will use offset and the record number to start; for the first request, we use zero, /offset/0. To select only the data that entered between August 1 and September 30, 2020, we will add a date_column /date_column/CreatedOn. Next, we need to add the range by defining the start and ending dates, /start_date/2020-08-01/end_date/2020-09-30. You can return all the columns of data, or you can choose only a specified set of columns, /columns/CreatedOn:CoName:CoAddress:CoCity:CoCounty:CoState:CoZip:HlName:HlAddress:HlCity:HlCounty:HlState:HlZip. Our last step is to add the API key value at the end of the URL, this will we the query value and will start with a question mark, ?X-API-KEY=59656247-2de2-4fc9-bdc7-7cd63de01fcc.

As described in the previous paragraph, our completed URL will look like the following:

The next set of data starting at record 200:

https://data.dol.gov/get/vets4212dataset/format/xml/limit/200/offset/200/date_column/CreatedOn/start_date/2020-08-01/end_date/2020-09-30/columns/CreatedOn:CoName:CoAddress:CoCity:CoCounty:CoState:CoZip:HlName:HlAddress:HlCity:HlCounty:HlState:HlZip?X-API-KEY=59656247-2de2-4fc9-bdc7-7cd63de01fcc

For more information on filtering data, visit https://developer.dol.gov/accessing-the-apis-using-http-requests/#apiv2.