Estimated Improper Payment Rate for the period from July 1, 2019 through June 30, 2022: 18.03%

Three-Year Improper Payments Estimate: $548,992,199

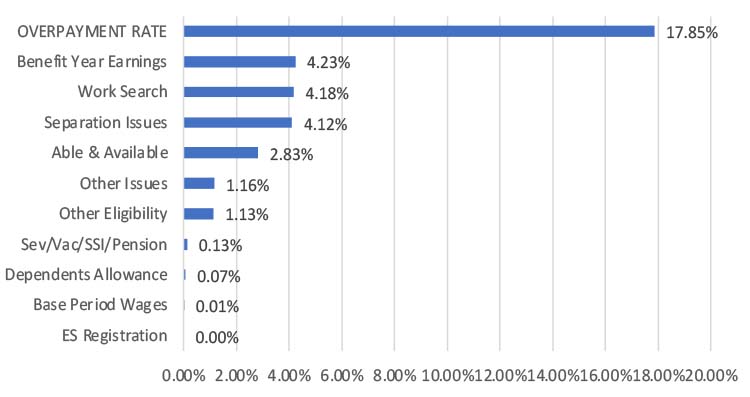

Unemployment Insurance (UI) Improper Payment Root Causes as a Percent of Total UI Benefits Paid

The Payment Integrity Information Act (PIIA) of 2019, requires programs to report an annual improper payment rate below 10 percent, and the UI program established a performance measure for states to meet the 10 percent requirement.

This bar chart depicts the state's estimated overpayment and root cause rates as a percent of total UI benefits paid for the three-year period from July 1, 2019 through June 30, 2022:

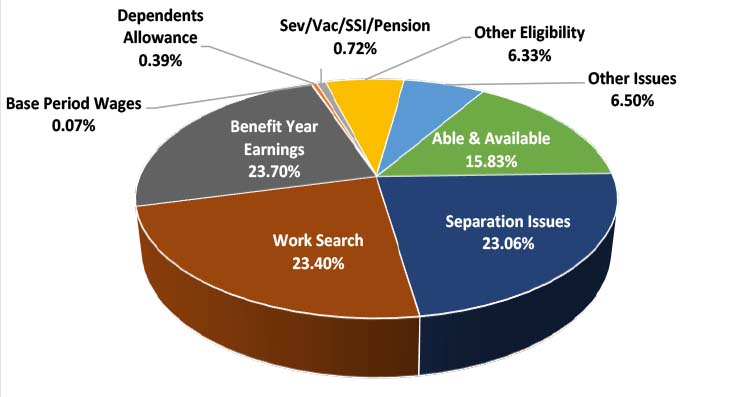

UI Improper Payment Root Causes as a Percent of Overpayments

This pie chart depicts the state's estimated overpayment root causes as a percent of total overpayments for the three-year period from July 1, 2019 through June 30, 2022:

|

View current root causes of Unemployment Insurance improper payments by state. |

Download and view improper payment data for the Unemployment Insurance program. |

|---|